Vision

To deliver outstanding returns for our investors, harnessing their experience and our network to fuel the success of Scotland’s entrepreneurs and innovators.

Mission

To provide our members with carefully-curated opportunities to invest in the most innovative companies and to support their early stage development to fullest potential.

Sectors we invest in

Technology

Our technology portfolio

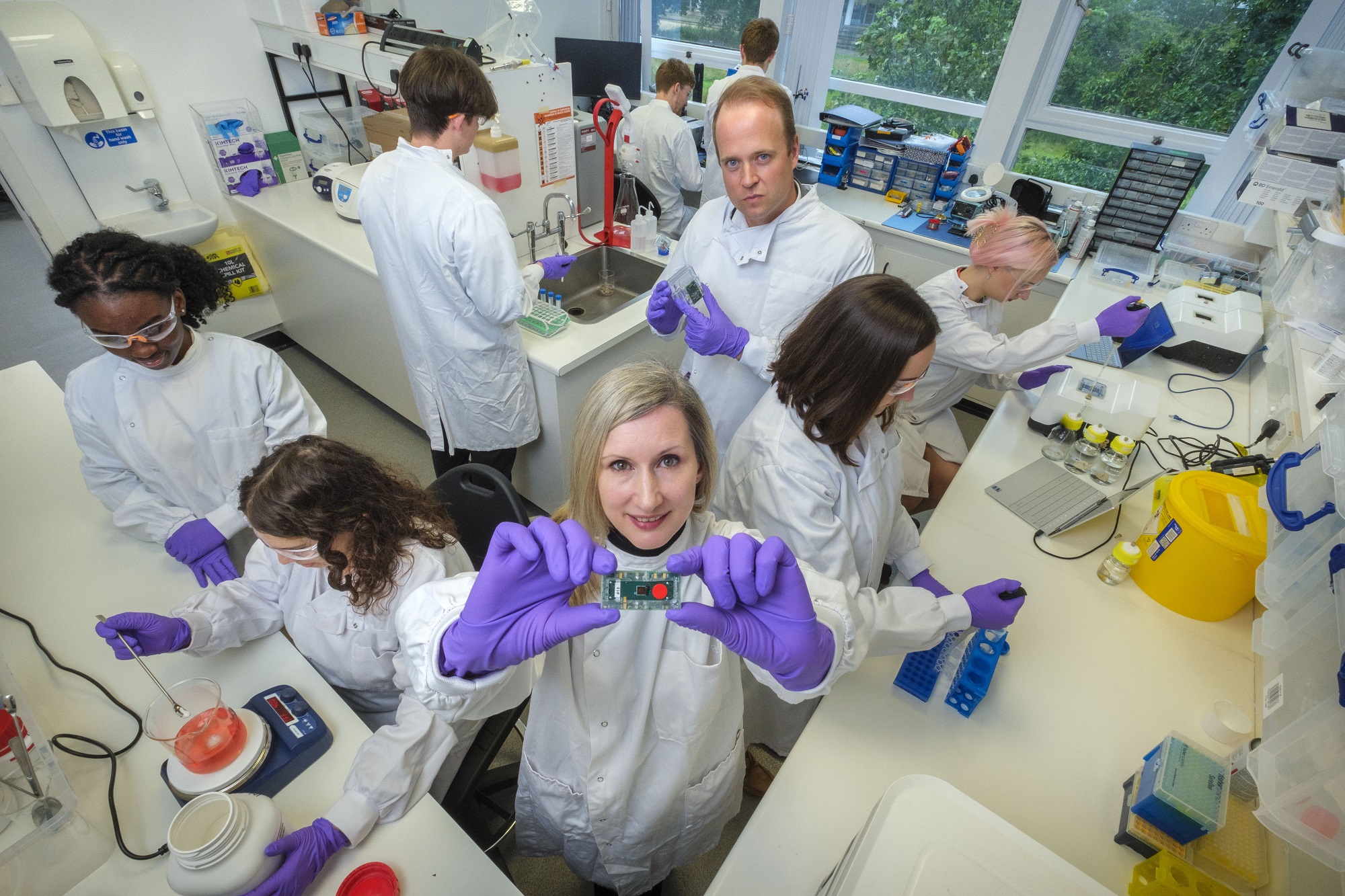

Life sciences

Our life sciences portfolio

Celebrating 30 Years Investing in Innovation

Play Video

From the blog

Latest news

Member of

Become a member

Our members are genuinely motivated to give something back and build great businesses in Scotland, as well as making a financial return.

Seeking investment?

If your business fits our investment criteria, we would love to hear from you. Click on the link below to send us your business plan.